ESG

SFDR DISCLOSURES

The Regulation (EU) no. 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR”) requires financial market participants such as Birdhouse General Partner (“Birdhouse GP”) to provide information to investors with regard to the integration of sustainability risks, the consideration of adverse sustainability impacts, the remuneration in relation to sustainability risks and the promotion of environmental or social characteristics, and sustainable investment.

We believe that in order to make good investments environment and/or social factors should not be overlooked and we intend to promote certain environment and/or social characteristics for the first fund managed by Birdhouse GP, i.e. Birdhouse Ventures Comm.V. (“Birdhouse” or the “Fund”)

To avoid any misunderstanding, we clarify that the Fund does not have sustainable investments, in accordance with article 9 of the SFDR, as its purpose.

You will find under Part I the Birdhouse GP AIFM level disclosures and under Part II the article 8 SFDR disclosures for the financial product Birdhouse.

Birdhouse AIFM level disclosures

The information below regarding the policies of Birdhouse GP on sustainability is made in accordance with articles 3, 4 and 5 of the SFDR (last updated in December 2022).

Integration of sustainability risk in the investment policies

A sustainability risk means “an environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of the investment”. For Birdhouse, sustainability risks are risks which, if they were to become reality, would cause a material negative impact on the value of its portfolio companies (“sustainability risk”).

Consideration of sustainability risks is embedded in the decision making and risk monitoring of Birdhouse in accordance with Article 3 of SFDR, and as included in Birdhouse’s ESG Guidelines (as defined below) which set out Birdhouse’s approach to ESG issues in the context of the investment decision-making process.

Prior to making any investment, we conduct a due diligence research on target entities. Alongside traditional due diligence information, Birdhouse GP incorporates important environmental, social and governance data and insights into its investment decision-making. Consideration of sustainability risk does not imply that a fund has a sustainable investment objective, but rather describes how sustainability risk is considered as part of the overall investment process. The outcome of the due diligence findings is taken into consideration when an investment decision is made by us.

Birdhouse GP includes ESG information, where relevant or available in the (i) initial screening of an investment opportunity, (ii) due diligence in relation to a potential investment, (iii) investment committee approval, and (iv) monitoring of the portfolio companies. This includes thematic sustainability information sourced from trustworthy sources and the use of an ESG due diligence questionnaire to identify, analyse and document sustainability matters. This information is used when reviewing and approving an investment opportunity.

Principal adverse impact of investment decisions on sustainability factors

In accordance with article 4.1(b) of the SFDR, Birdhouse GP states that it does not consider the adverse impacts of investment decisions on the sustainability factors as referred to in article 4.1(a) of the SFDR and does not make the disclosures as described in article 4.1(a) of the SDFR.

Given the size of Birdhouse GP’s organization with limited resources and personnel, we are not capable of determining precisely what the adverse impacts of our investment decisions would be based on the different criteria set forth in the SFDR and the legislation implementing the SFDR. In addition, we are currently not in a position to obtain and/or measure all the data which would be required by the SFDR to report, or to do so systematically, consistently, and at a reasonable cost with respect to all our investment strategies.

Integration of sustainability risk in the remuneration policy

Birdhouse GP, as a sub-threshold manager of the alternative investment fund Birdhouse Ventures does not have an obligation to have a formal remuneration policy in accordance with article 40 and following the Belgian law of April 19, 2014 on alternative entities for collective investments and their managers.

In practice, in accordance with general venture capital remuneration and award processes, a significant portion of an investment professional’s compensation is typically in deferred instruments aligned to the performance of investments, meaning that the value of an investment professional’s compensation will be negatively impacted by a sustainability risk that impacts the value of the underlying investment.

Birdhouse article 8 SFDR disclosures

Summary

Birdhouse Ventures Comm.V (the “Fund”) is a financial product that promotes environmental and/or social characteristics, but does not have as its objective sustainable investment and does not invest in sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and/or social characteristics promoted by the Fund.

The Fund is an early-stage venture capital fund which will be focused on early-stage companies with a scalable business model, mainly technology or technology enabled, which are or were in the past admitted to The Birdhouse accelerator program.

The investment strategy will more specifically focus on companies active in certain verticals, including AgeTech and other verticals.

No sustainable investment objective

This financial product promotes environmental or social characteristics, but does not have sustainable investments as its objective.

Environmental or social characteristics of the financial product

The Fund will strive (i) to invest in companies that are consciously working to create a diverse leadership team — one that’s inclusive across gender, ethnicity, age, sexual orientation, disabilities and national origins and (ii) to make investments, taking into account environmental and/or social characteristics, inter alia comprised of climate and environmental (including but not limited to energy consumption, waste management, CO₂ footprint, availability of sources), health, safety, employment conditions and good entrepreneurship.

The Fund also aims to have social impact by means of its specific focus (for part of the Fund portfolio) on companies that are active in agetech. These companies develop technology designed to meet the needs of older adults and those who care for them. The aim is in general to help older adults live and age in a better (health) condition but also better circumstances, e.g. by means of (mental) health, communication, mobility and other platforms.

Investment strategy

The investment strategy of the Fund will be focused on early-stage companies with a scalable business model, mainly technology or technology enabled, which are or were in the past admitted to The Birdhouse accelerator program.

The investment strategy will more specifically focus on companies active in certain verticals, including AgeTech and other verticals.

The Supervisory LP Board determines the environmental, social and governance guidelines (the “ESG Guidelines”) to be considered for purposes of making investments in portfolio companies, and verifies compliance of the relevant investment opportunities with the ESG Guidelines brought to the Supervisory LP Board.

The Fund does not directly or indirectly invest in, guarantee, or otherwise provide financial or other support to companies or other entities that engage in certain activities and/or sectors and are explicitly excluded in the product documentation.

Such exclusions i.a. relate to companies which:

- do not comply with the Ten Principles of the UN Global Compact in the areas of human rights, labour, environment and anti-corruption

- are active in arms trade and exports

- are active in palm oil, nuclear power plants, coal-fired power plants, shale oil and gas, mining projects, drift nets, asbestos fibres, tobacco products,

- are located or active in tax havens

- engage in speculative activities on agricultural products or commodities

- are active in online gambling and betting.

A pre-investment analysis of the good governance practices of investee companies is an integral part of the risk and impact screening for ventures of the Fund. Good governance, including but not limited to sound management structures, employee relations, remuneration of staff, and tax compliance are an integral part of the transaction documentation for investments.

Post-investment good governance is monitored during the annual ESG monitoring and regular board meetings, since, by being an active investor, the Fund aims for a board or observer seat in the portfolio companies. The Fund should be in a position to monitor the portfolio companies’ compliance as well as advise them on appropriate governance standards, taking into account the early stage and size of their business.

A detailed overview of our good governance practices is provided in our ESG Guidelines.

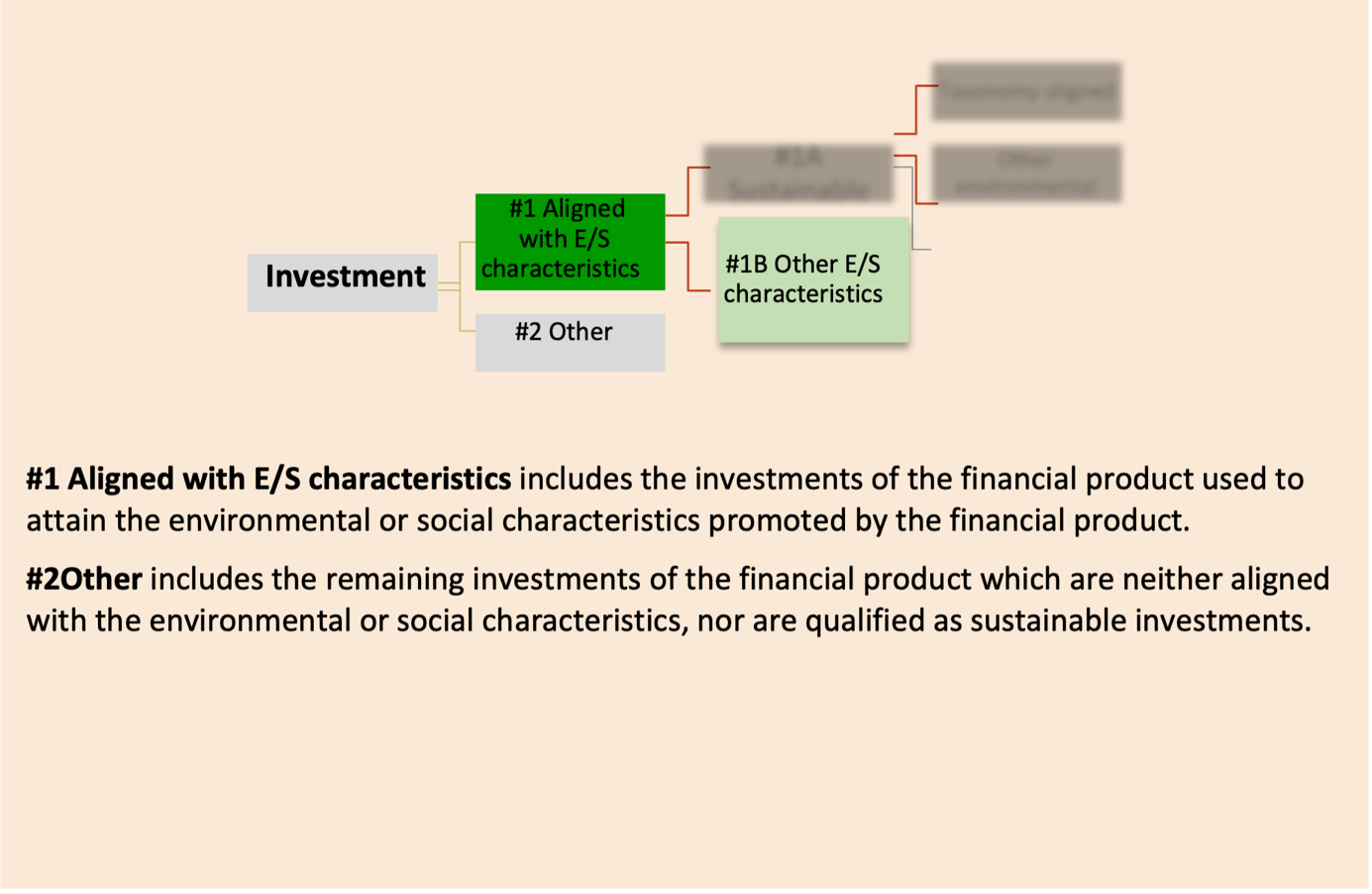

Proportion of investments

All investments of the Fund can be categorized as “#1 Aligned with E/S characteristics”. None of the Fund’s investments are included under “#2 Other”.

Our investment strategy leads us to invest in companies at a very early stage in development, often just consisting of a few team members and a technology prior to proof of concept. As a result, we consider the direct impact on environmental factors still relatively low for almost all our portfolio companies. We believe that their positive impact will be larger on the social and governmental characteristics, hence we expect the accurate proportion of our investments to evolve over time, as the additional SFDR related frameworks regarding social and governmental characteristics are rolled out.

Our ESG Guidelines and assessment are tailored to the needs of, and requirements for, early-stage companies. Our approach is detailed in two procedures: an ESG assessment (pre-investment) and an ESG monitoring and reporting (post-investment).

Monitoring of environmental or social characteristics

We believe that applying ESG Guidelines not only mitigates business risks, but also creates long-term value for businesses, resulting in better financial return for the Fund. Hence, the Fund strongly encourages its portfolio companies, their founders and CEOs to actively incorporate ESG principles in their daily business activities.

Through an annual follow-up of the ESG performance of the portfolio companies of the Fund, the Fund aims to identify and improve, as the case may be, the environmental consequences, social and human rights issues of an investment, the observation and acknowledgement of fundamental employees’ rights, the absence of corruption and bribery by any of the parties involved in the investment, and the compliance with applicable environmental, human rights and labor rights.

The Fund aims to take a board or observer seat in its portfolio companies. Therefore, the Fund should be in a position to monitor the companies’ ESG compliance, their financial and non-financial performance, and to advise them on appropriate ESG standards, taking into account the early stage and size of their business.

The task of monitoring the ESG commitments is assigned to the investment professional or venture partner of the Fund dedicated to the specific portfolio company (the “Portfolio Manager”). It is the daily responsibility of the Portfolio Manager to monitor the performance of the portfolio company, linked to predefined indicators. The performance results are shared with the Supervisory LP board in the annual ESG reports. In case the investment performance is considered non-compliant with the ESG Guidelines, the Portfolio Manager will proactively engage with the portfolio company to mitigate issues and find a solution. In case no solution is identified the problem is escalated and addressed in the board of the relevant portfolio company.

Methodologies

Qualitative performance monitoring in the field of ESG themes is done on a regular basis through the contacts that the Portfolio Managers maintain with the portfolio companies. When observations or incidents occur at the portfolio companies related to the topics as defined in the ESG policy, these are followed up by the Portfolio Manager and, where necessary, escalated within the relevant governance structure. In addition, an annual formal screening takes place where both the risk and impact performance results are analyzed, and where necessary the dialogue is opened to realize improvements or report positive realizations correctly.

Data sources and processing

To measure the ESG performance of the Fund, data on the portfolio companies’ products or services are sourced from the companies themselves through interviews.

Pre-investment, this ESG-related risk assessment and impact data gathering is an integral part of the due diligence on the prospective ventures of the Fund. Each time the Fund makes an investment, the portfolio company’s focus will be screened for any exclusion criteria and its ESG-related risk factors are detailed, according to the procedure described in the ESG Guidelines.

In the definitive transaction documentation each portfolio company is required to agree to ESG related undertakings, including but not limited to sound management structures, employee relations, remuneration of staff, and tax compliance.

Post-investment, the ESG data and performance analysis of all portfolio companies of the Fund are updated on an annual basis through a detailed interview with the portfolio companies to reflect evolutions in their processes, products, or management structure.

Reporting on the Fund’s investments will be done in accordance with Annex IV to the Regulatory Technical Standards of the SFDR.

Limitations to methodologies and data

Data quality and reliability is largely anchored on the data gathered by the portfolio companies themselves, and the analyses of our Portfolio Managers, that is largely based on a limited set of comparison data.

However, our investment horizon is at a very early stage and the relevance of the data is relative. The companies that the Fund invests in, are not yet at scale level, so the impact on the environmental or social characteristics is not always representative.

Due diligence

The Fund conducts due diligence on the company’s technology, team, commercial roadmap, financial and legal status, intellectual property strategy, as well as on ESG and impact aspects.

An ESG-related risk assessment and impact analysis is thus an integral part of the due diligence performed by the Fund.

Please refer to the Sections “Investment Strategy” and “Data Sources and processing” above for a further description of the Fund’s due diligence.

Engagement policies

Following an investment and during the holding period, the Portfolio Managers monitor the portfolio companies’ ESG compliance, as well as their financial and non-financial performance, taking into account the stage of maturity of the portfolio company.

The executive task of monitoring the ESG commitments is assigned to the Portfolio Manager of the Fund dedicated to the specific portfolio company.

In the definitive transaction documentation each portfolio company is required to agree to ESG related undertakings, including but not limited to sound management structures, employee relations, remuneration of staff, and tax compliance.

Index as reference

Not applicable since there is no reference benchmark designated for the purpose of attaining the environmental and/or social characteristics promoted by the fund.